An inspiring yet relatable statement for SMEs and entrepreneurs. It captures the excitement of endless ideas driving South Africa’s business owners, while echoing their frustration: scaling up and securing funding.

In the latest episode of the Cutting Edge Podcast, which takes place at a live recording of an event hosted by 100 Women in Finance and organised by Edge Growth Ventures, Zinathi Gquma (Business Day TV) moderates a panel of business leaders: Sizwe Ndlovu (CTO, Pineapple Insurance), Noluvo Nela (Partner, Edge Growth Ventures), and Cleola Kunene (Head of SME Development, JSE).

Together, they share their perspectives on tackling customer pain points, what makes SMEs stand out to investors, and how to leverage networks to open new markets.

Here are the five insights to help guide your small business to success in securing funding ⬇️

1. What Problem Are You Solving That Customers Will Pay For?

Is your innovative idea solving a problem that customers value enough to pay for? Sizwe (CTO at Pineapple) shares his approach when it comes to the development of Pineapple Insurance. The Pineapple founding team focused on the pain point of ‘making insurance feel less like a chore’ rather than jumping straight to a solution. By doing so, they simplified their product and made insurance far more appealing. “We focus on the problem, not the solution. People get hung up on their product, but if no one needs it, it’s useless.” By simplifying the process of submitting claims, Pineapple builds customer loyalty daily.

What should you do next?

↳Identify a specific customer pain point your business can fix

↳Ask: Will people pay for this solution?

By tackling a problem customers truly value, you’ll lay the foundation for a business that not only innovates but also attracts the funding necessary to grow.

2. How Can You Use Technology as a Competitive Advantage?

Not every business owner has equal access to technology and internet connectivity. This “digital divide” poses a challenge, but technology can give your business a powerful edge.

By using technology to streamline tasks and deliver faster, smarter services, SMEs can outpace corporates and win loyal customers. Zinathi asks the panel, “Can SMEs innovate without tech?” The panel answers by stating what’s accessible to stand out now, whether it’s the latest AI software or sharing a laptop with your business partners.

Here’s Your Next Step:

1️⃣ Pick something that technology could make easier, like sending invoices or organising your systems.

2️⃣ Look into free tools…They’re like hidden gems that can lighten your workload without breaking your budget.

💭 Reflect: What technology can you test this week to boost your business’s efficiency?

3. Are You Ready to Embrace the Accountability That Funding Brings?

Funding is more than cash; you’re handling someone else’s money with care. That makes it a commitment. Cleola (Head of SME Development at the JSE) compares this relationship with your funder to a marriage, where “everybody loves the wedding day, but no one wants to do the work of the marriage. Funding brings accountability when using someone else’s money.”

For someone like Noluvo, who’s constantly in rooms with funders, this means SMEs must show tangible results, whether it’s early customer traction or proven revenue streams. She explains that investors are cautious, but a track record of small victories builds confidence. These wins signal that your business can handle capital responsibly, encouraging funders to take a chance on you.

What to do next:

🟢 Audit your financials and contracts. Would you be able to present them to funders?

🟢 Map out how funding will drive growth, not just fill the gaps.

💭 Ask yourself: If you’re about to pitch to funders, what’s one weak spot in your business setup you can strengthen to win their trust?

4. Who Can You Partner with to Unlock New Markets and Credibility?

Partnerships open doors to growth, not only financially but also through non-financial support. Most founders overlook this because their main focus is getting funded. But things like mentorships, networks, and expertise can be game-changers for your business.

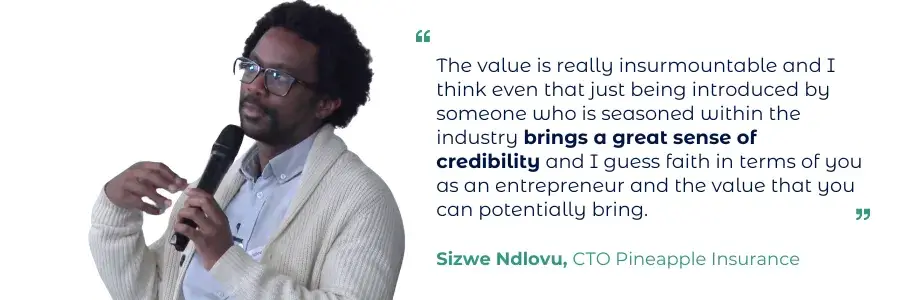

Sizwe values connections. By partnering with corporates or hubs, SMEs can gain access to their expertise, from strategy tips to market insights, without needing upfront cash.

Noluvo (Partner at Edge Growth Ventures) sees a win-win opportunity. With SMEs being the primary job creators in the country, corporates can “gain by strengthening their supply chains with innovative SMEs.” Teaming up with corporates or hubs gives you access to their resources, and you gain their expertise and market connections without needing cash up front.

Find partners who fuel your success with more than money.

1️⃣ Think about your industry. Whether it’s marketing, insurance, or another sector, who’s a corporate hub or mentor that could share expertise or connections?

2️⃣ Sign up for a local business event. Small events or expos are perfect ways to network and find potential allies.

3️⃣ Ask a trusted contact for an introduction to someone who can offer guidance. This can lead to finding a mentor and gaining more industry insight from an expert.

5. How Can You Align Your Innovation with Market Trends to Attract Funders?

Funders don’t back ideas alone; they invest in SMEs that ride the wave of current market trends. Noluvo shares how SMEs should seize opportunities:

Spotting trends, like sustainable products, lets you position your business as a market leader. This allows you to identify problems that can be solved by improving an industry, not changing it. That is forward thinking.

Owning a unique solution tied to a growing trend makes your small business a magnet for investors. Sizwe shares Pineapple’s approach: “There’s always new tech trends, but you must show that your investment won’t fizzle out.”

Align your innovation with what’s next to grab funders’ attention:

Here’s Your Next Step:

🔵 Look around your industry. What’s one trend, like eco-friendly packaging or online services, that your SME could tap into? Remember, you are improving the industry, not changing it.

🔵 Brainstorm a simple way to tweak your product or service to match that trend.

🔵 Talk to customers or peers to check if this trend matters to them. This way, you are testing the waters before diving in.

Your Mission as a Founder:

The panel’s message is clear: innovation drives your business, but action unlocks its potential. The panel agrees that South Africa’s SMEs can reshape the economy.

As a founder, you must answer these questions to solve problems, embrace tech, prepare thoroughly, be patient with pitching, and forge partnerships.

Your business’ success creates jobs and lifts communities. It drives change in the country’s economy.

With this in mind – Take Action Today❗Innovation is your edge, and funding rewards preparation.

🎙️ Want more insights? Catch the full episode of the Cutting Edge Podcast, where seasoned leaders and investors share expert insight into funding strategies for South African SMEs. Listen to it here.

Panelists: Cleola Kunene (Head of SME Development, JSE), Nolu Fani (Partner, Edge Growth Ventures), Sizwe Ndlovu (CTO, Pineapple). Moderator: Zinathi Gquma.