Harnessing the Power of Impact Investing to Unlock SME Growth

South Africa’s venture capital (VC) ecosystem is a pertinent contributor to the growth of Small and Medium Enterprises (SMEs) in South Africa. VC plays a key role in providing funding to SMEs otherwise considered too early-stage and thus too high-risk for traditional funding institutions. Additionally, VCs often bring more than funding to the table, providing valuable guidance and mentorship to SMEs to support them on their growth trajectories.

Despite macroenvironmental challenges, the Southern African Venture Capital and Private Equity Association (SAVCA) reports that 2022 marks the fifth consecutive year of over a billion rand invested into SME businesses by early-stage fund managers active in the Southern African Venture Capital asset class. This level of support for high-growth, high-job-creating, early-stage businesses has the potential to create a significant impact for South Africa.

“VC is important because it’s all about impact”, says financial services expert Melanie de Nysschen who supported the Southern African Venture Capital & Private Equity Association (SAVCA) in the execution of its fund manager development programmes. “We don’t share our stories about impact enough so that people can understand and appreciate how important venture capital is”. Melanie asserts that VC holds great potential to create impact and unlock Africa’s economic growth potential in the following ways:

Job Creation

VC funding bolsters job creation by supporting the growth and development of SME businesses. These businesses are the growth engines of the African economy, comprising 80-90% of all enterprises and generating jobs for approximately 85% of the workforce across the continent.

Innovation

VC supports startups and early-stage businesses leveraging technology to massify access to essential products and services. “Technology can be used in extraordinary ways to create connections and access to services that we would otherwise have never had – and VC can unlock it”, explains Melanie.

Transformation, Diversity & Inclusion

VC plays a role in the democratisation of the economy by providing funding and support to a diverse range of entrepreneurs, thus mitigating the effects of uneven wealth distribution.

Impact Investing in Venture Capital

Impact investing in venture capital refers to the practice of making investments in early-stage companies to generate positive social or environmental impact alongside financial returns. This approach goes beyond traditional venture capital, where the primary focus is on financial gains. Impact investing aligns with the growing recognition that businesses can be a force for positive change, addressing pressing global challenges while also being profitable.

Impact investing is growing, with the Global Impact Investing Network (GIIN) suggesting that the market has expanded 63% since 2019 to reach approximately $1.2 trillion at the end of 2021. This growth is reflected locally. While little data presently exists for venture capital specifically, Melanie says that 57% of private equity firms in South Africa have impact mandates, up from 45% the previous year, and 79% of the remaining 43% are likely to implement such mandates in the next five years, supported by data reported by SAVCA.

Impact investing refers to investments in early-stage businesses creating positive social or environmental outcomes in sectors such as renewable energy, healthcare, education and sustainable agriculture. According to the 2022 AVCA Venture Capital in Africa report, the top five impact categories amongst VC deals with impact investor presence are financial inclusion (17%), sustainable agriculture and forestry (16%), clean energy (16%), access to quality education (10%) and access to quality healthcare (8%).

Bearing some correlation, the five sectors that attracted the greatest number of VC deals in 2022 in South Africa are fintech (14.7%), biotechnology (10.9%), business products and services (7.7%), agritech (7.7%) and medical devices (7.1%) as reported in the SAVCA 2023 Venture Capital Survey.

Sustainable Development Goals

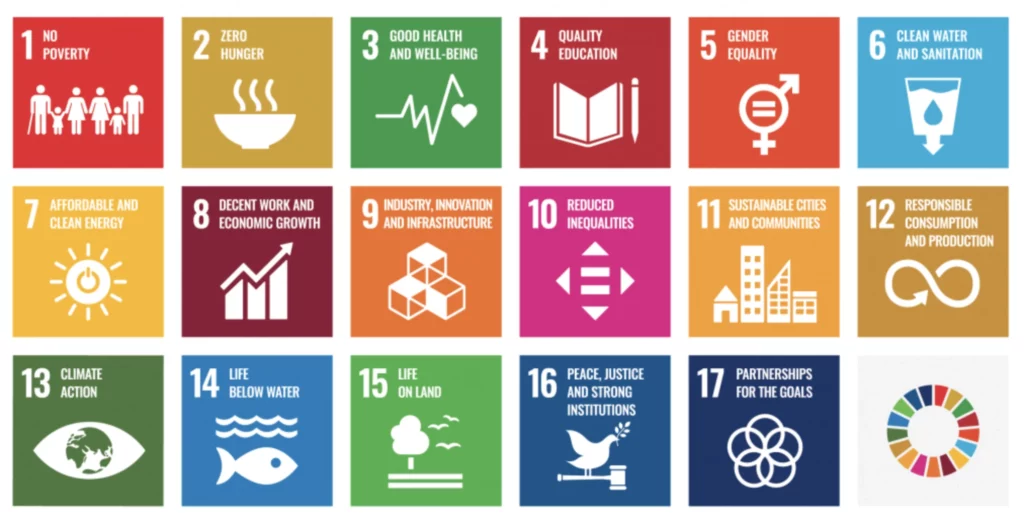

Impact investing requires we evaluate the impact of our investments beyond financial returns. It requires that we assess our investments’ contribution to broader societal and environmental goals. The Sustainable Development Goals (SDGs), a set of 17 global goals established by the United Nations in 2015 as part of the 2030 Agenda for Sustainable Development, are designed to address various global challenges and promote sustainable development across economic, social, and environmental dimensions.

SDGs can provide a comprehensive framework for measuring and analysing the impact of venture capital investments on sustainable development. In fact, the 2023 GIINsights reveal that over three-quarters of investors rely on SDGs as a framework to guide their impact strategies. At Edge Growth, we too have utilised the SDGs to define our impact framework.

UN Sustainable Development Goals

Melanie states that VC contributes significantly to the sustainable development goals by:

- Expanding access to essential goods and services in key sectors.

- Facilitating SMEs’ access to markets and financing.

- Supporting Innovation and entrepreneurship.

- Creating jobs at scale.

- Developing sustainable solutions contributing to the green transition.

- Democratising access to capital.

There are many ways in which SDGs can be used as a lens to evaluate the impact of VC investments in small businesses. Here are just a few ways to assess investments against the SDGs:

- SDG Alignment

Identify which SDGs align with the mission and activities of the small businesses receiving VC investments. For example, businesses focused on clean energy may align with SDG 7 (affordable and clean energy), and businesses focused on healthcare or edutech may align with SDGs 3 (good health and wellbeing) and 4 (quality education) respectively. - Social Impact

Assess the social impact of VC investments by considering factors such as job creation, employee well-being, and community development. Evaluate the extent to which the businesses promote gender equality, decent work, and reduced inequalities (SDGs 5, 8, and 10). - Environmental Impact

Examine the environmental sustainability practices of the small businesses. This could include assessing their carbon footprint, resource efficiency, and waste management (SDG 12 – Responsible Consumption and Production). - Innovation & Technology

Measure the degree to which VC-backed businesses contribute to technological advancements, innovation, and infrastructure development (SDG 9) and reduced inequalities (SDG 10). - Partnerships for the Goals

Evaluate the extent to which small businesses engage in collaborations and partnerships that advance sustainable development goals. This could include partnerships with investors, NGOs, government agencies, or other businesses (SDG 17).

By integrating the SDGs into the evaluation framework for VC investments in small businesses, stakeholders can gain a more comprehensive understanding of their impact on sustainable development, fostering a more responsible and purpose-driven approach to venture capital.

Impact Tracking, Measurement & Reporting

Impact tracking, measurement and reporting are essential for several reasons:

- Measurement mechanisms foster accountability and transparency. Stakeholders want to know how capital is being deployed and whether it is making a tangible difference.

- Impact measurement allows for benchmarking and comparison of different investments, sectors, or funds. Investors can assess the relative success of their portfolio compared to industry standards, facilitating continuous improvement and learning.

- Regular impact assessment enables investors and businesses to learn from successes and failures. This iterative process of measurement and improvement contributes to the evolution of best practices in impact investing and venture capital, driving positive change in the long run.

However, the consensus amongst stakeholders in South Africa is that effective impact measurement presents a challenge for the SME development ecosystem. To successfully report on impact, we must ensure that we are effectively measuring the impact performance of our investments. We then need to make this data available to the wider ecosystem for benchmarking. Lastly, but by no means least, we need to foster greater collaboration and engagement amongst ecosystem stakeholders to learn from each of our wins and losses to make improvements.

This was one of the factors that inspired and encouraged us to release our first-ever Impact Report, the development of which was led by our CEO of Edge Growth Ventures, Janice Johnston. “We are using this Impact Report as a prototype to engage with the broader ecosystem and its stakeholders to determine how we can improve impact measurement and how we can take measurement and tracking, as well as the intentionality of the impact that we seek to achieve, to the next level”, says Janice. Our 2023 Impact Report can be accessed via our homepage.