Exploring Alternative Funding Solutions

Access to funding is one of the most significant constraints to SMEs’ growth, sustainability, and productivity. The perceived riskiness of SMEs and the lack of readily available financial data and credit information contribute to a shortage of formal banking products that can cater to small businesses at various stages of their life cycle, particularly the early stages. As Mike Sage, FNB executive, investor and Vumela Fund trustee explains in the Lifting Barriers to SME Funding episode of The Cutting Edge podcast, “in the more regulated banking environment you need quite a lot of track record, you need a balance sheet, you need equity, you need cash flows to prove affordability and all these kind of things”.

This presents a challenge to SMEs who can’t access credit due to the reams of financial documentation and collateral requirements needed for SMEs to obtain a loan, not to mention the high costs and high-interest rates on these loans. Developing new and innovative alternative funding solutions can help bridge the gaps in the SME funding ecosystem and provide small businesses with the necessary capital they need to scale. By diversifying SME funding in South Africa, we can provide funding solutions for every stage of the SME growth cycle thereby increasing their resiliency, scalability and sustainability.

Vumela 4.0: Designing Alternative Funding Solutions to unlock access to capital for South Africa’s SMEs

For SMEs to contribute to innovation, employment and overall economic growth, we need to broaden the range of funding solutions available to them. The recent launch of Vumela 4.0, a fund pioneering new and innovative alternative funding products for South Africa’s SMEs, serves as a case study to demonstrate how SME ecosystem players are designing solutions to solve this need. The fund comprises two SME funding products, each designed to fill the gaps in the SME development landscape, particularly for often-overlooked early-stage businesses:

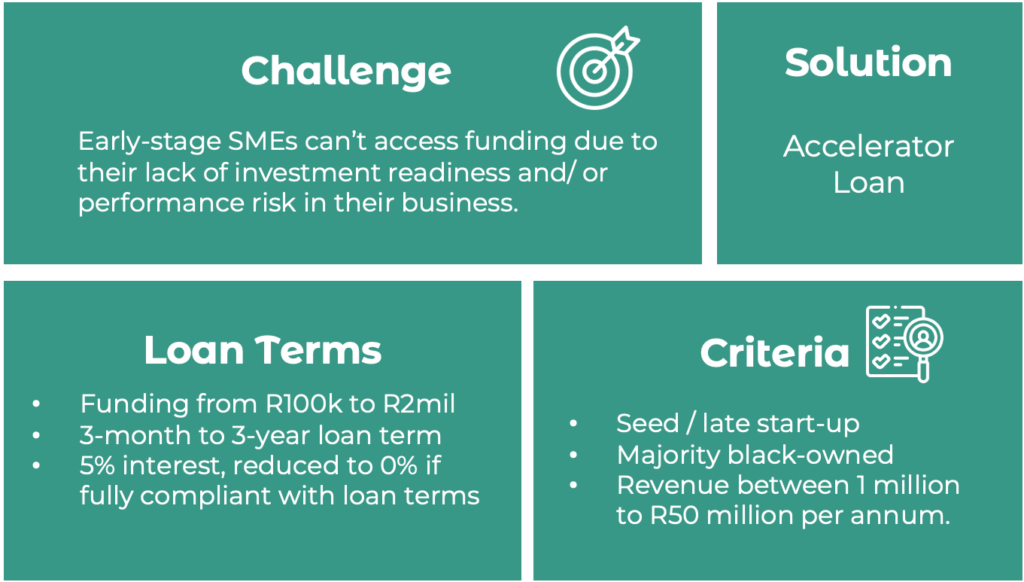

1. Accelerator Loan

The Accelerator Loan is designed to cater to the needs of very early-stage businesses that can’t access funding for purchase orders, working capital, operational expenditure or capital expenditure due to their lack of investment readiness or performance risk within their operations. The accelerator loan makes rapidly accessible low-cost funding available to these businesses without the financial documentation required by traditional lenders. As an added incentive, SMEs can even reduce the interest on their loan to 0% if they remain compliant with the loan terms.

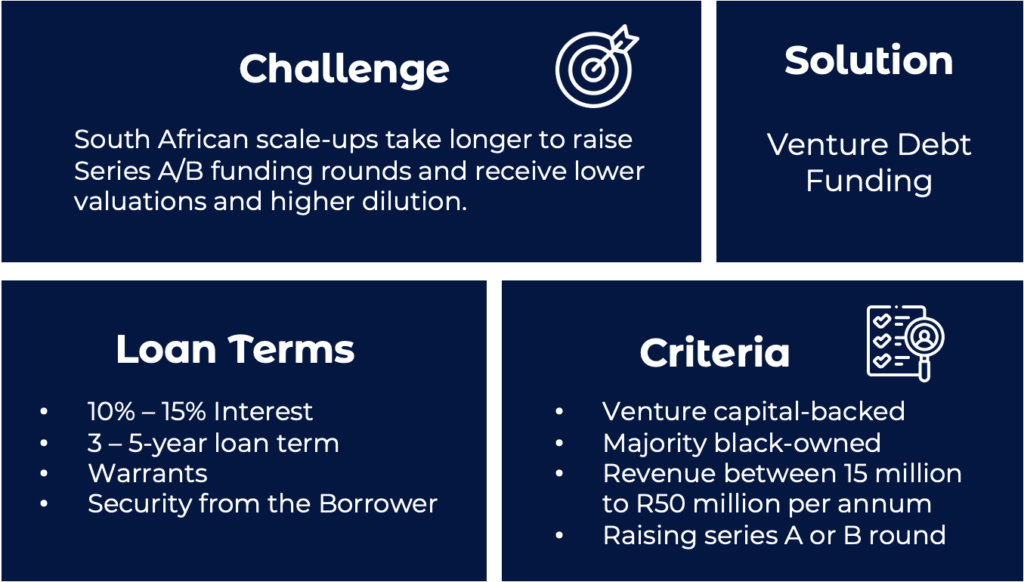

2. Venture Debt Funding

Venture Debt is designed to meet the funding needs of venture capital-backed scale-ups facing cash constraints or having difficulty closing a funding round. “Our venture capital industry has grown a lot over the last ten years, but there are still gaps, particularly in the seed funding stage,” says Richard Rose, CEO of Edge Growth Ventures. “We conceptualised a venture debt product which will be a first-of-its-kind in South Africa and possibly the African continent”. With venture debt funding, VC-backed scale-ups can access additional funding required for working capital, capital expenditure or operational expenditure without further dilution.

Developing alternative funding solutions is crucial for addressing the problem of access to funding for small businesses. Vumela 4.0 solves for this by providing more flexible, accessible and innovative funding options to SMEs and presents a case study for players in the SME funding space who are looking to achieve the same.

About The Vumela Enterprise Development Fund

Understanding the need for innovative funding mechanisms for SME growth, FNB Business Banking imagined a means to provide SMEs with access to funding unrestricted by the prudential regulations of traditional banking. The objective was to create an innovative and sustainable model for a financially and operationally independent investment business to invest in SMEs. What would stem from this is the SME fund named the Vumela Enterprise Development Fund the first fund of its kind in South Africa.

Pioneered by FNB Business Banking and Edge Growth, the Vumela Fund would present a blueprint for many Enterprise and Supplier Development (ESD) and SME development funds to come. Founded in 2009 to create jobs and alleviate poverty, the Vumela Fund invests in high-growth SMEs with good economic and impact returns. In addition to providing SMEs with the funding they require to scale, Vumela offers non-financial growth support addressing another constraint to SME growth being access to skills; and provides access to market opportunities through supplier development relationships with many South African corporates.

Vumela 4.0 is the fourth iteration of the Vumela Fund to which FNB has contributed R200 million with the goal to scale 150 businesses and create over 1000 jobs. To date, the Vumela Fund overall has deployed R403 million to early-stage SMEs and has created over 7000 jobs.

Discover how Edge Growth can assist your organisation to invest in SME development.