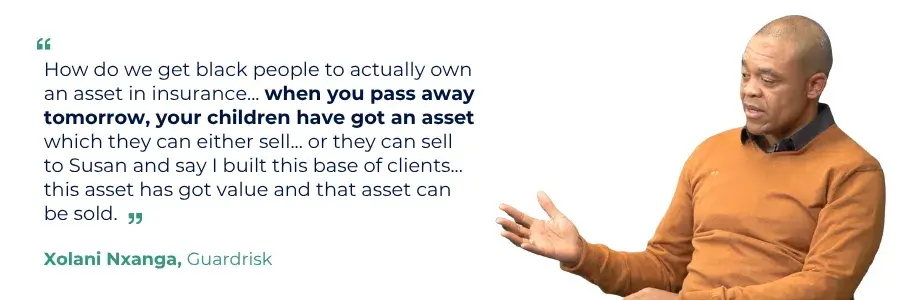

This painful truth shared by Xolani Nxanga, Managing Executive at Guard Risk, exposes the harsh reality facing many financial advisors in South Africa: despite working tirelessly for many years, they often find themselves with no wealth to pass on to their families.

While the industry generates billions in premiums and investments, many advisors and brokers depend solely on commissions. They earn substantial incomes while working, but when they retire or pass away, their income comes to a sudden halt, leaving little to no assets behind for their families.

For black financial advisors in particular, this represents more than just a business challenge. It’s a critical barrier to wealth creation and economic transformation in post-apartheid South Africa.

In a revealing conversation on The Cutting Edge Podcast, industry experts Xolani Nxanga (Guard Risk) and Tokollo Mahapa (Sytra Consulting), alongside host Susan Moloisane, CEO of Edge Growth Solutions, discuss how financial advisors can break free from commission dependency and build businesses that create lasting wealth.

Here are 4 proven strategies to transition from earning commissions to building generational wealth: ⬇️

1. Stop Renting and Start Owning

Instead of working as an agent selling insurance products on behalf of big companies, become an owner of your own insurance business through a cell captive model. Think of it as evolving from an Uber driver earning per trip to owning your own taxi company.

As an agent, you sell products set by big insurers, earn commissions only when you make a sale, and stop earning if you stop working. You don’t control the products and don’t own anything of value. A cell captive lets you “rent” an insurance licence from a company like Guard Risk without the huge costs of starting your own insurer.

Real-world example: When your clients need specific coverage that doesn’t exist in the market, you can create it yourself and profit from it, rather than asking a big insurer who might refuse your request.

This approach has clear benefits:

✅ Create tailored products that meet your clients exact needs.

✅ Earn significantly more than traditional commissions.

✅ Build a valuable, sellable business asset.

✅ Create an inheritance for your children.

By owning a cell captive, you’re building a real business with equity, not just a job dependent on big insurers.

2. Build Client Relationships That Span Generations

Shift your focus from once-off transactions to long-term relationships that compound in value over decades.

This approach creates multiple revenue streams:

🟢 Comprehensive financial planning across all life stages, from first job to retirement.

🟢 Multi-generational education teaching entire families about money management.

🟢 Estate planning services helping clients transfer wealth effectively.

🟢 Business succession planning for entrepreneurial clients.

Building relationships with the younger generation also helps you stay current with technology and innovation.

This helps you learn how to expand your business and incorporate new ideas that improve existing concepts. For instance, integrating AI and technology into your business to be more efficient and communicate effectively with younger clients.

💡 The key insight: Instead of chasing new clients constantly, build deeper relationships with fewer families over decades. Deep relationships generate far more wealth than endless transactions.

3. Earn Trust Through Education and Consistency

Building trust as a black financial advisor can be tough due to historical biases and industry stereotypes.

Here’s your trust-building strategy:

➡️ Educate your community by hosting financial literacy workshops.

➡️ Utilise technology to maintain regular client contact through email updates and mobile apps.

➡️ Be radically transparent, honest, and clear with clients about their financial journeys.

➡️ Stay committed to supporting clients well beyond the initial sale.

Begin by pioneering these concepts within the community to change the stigma surrounding the relationship black people have with money. This could even involve advocating for mandatory financial education in schools, helping the community develop a healthy relationship with money from an early age.

💡 Key Insight: Black financial advisors can overcome trust barriers by consistently educating their communities and using technology to maintain relationships. This positions them as teachers rather than salespeople.

4. Build a Business, Not Just a Job

Stop thinking like an employee earning a salary and start thinking like a business owner creating something valuable.

Here’s how to do it:

⚪ Create smart systems that run smoothly without your constant involvement.

⚪ Build a capable team to help your business expand.

⚪ Reinvest profits strategically to fuel the growth of your business.

⚪ Plan ahead by building a sellable business or one that can be passed down to family members.

This approach helps you create a business with real operational value. Now more than ever, major insurance companies are open to partnering with advisors who bring strong client relationships and market knowledge to the table. New regulations support innovation, and technology has never made it easier to launch and scale a business. Remember: True transformation comes from building wealth-generating businesses, not just securing deals with established companies.

Overcoming the Challenges

The obstacles are real, but you can overcome them by:

✔️ Access to capital through cell captive models as they cost much less than starting your own insurance company.

✔️ Building trust through professional service and community workshops that build client confidence over time.

✔️ Handle regulations through technology that automates compliance and paperwork.

✔️ Gain skills through continuous learning and networking to build your expertise.

Moving Beyond Survival Mode:

This transformation requires a fundamental mindset shift:

🔵 From chasing monthly commissions to building a valuable business.

🔵 From knowing products to understanding business strategy.

🔵 From working alone to building a team and systems.

🔵 From serving clients to creating wealth for the future.

The Bigger Impact

Commission cheques stop when you stop working. A real business continues paying your family indefinitely.

As Xolani puts it: “When it comes to transforming the industry, we need meaningful and real wealth creation, not mere commissions.”

But this isn’t just about your family. When you build a successful, black-owned financial business, you’re proving something powerful to your community. You’re showing that we don’t just work in the financial services industry – we can own it.

Every black-owned business that thrives becomes a beacon of possibility. Your success changes not only your family tree but how the next generation sees what’s possible for them.

Where to Start:

If you’re an advisor ready to break free from commission dependency:

1️⃣ Assess your client portfolio and calculate the long-term value of your current relationships.

2️⃣ Explore ownership opportunities by researching cell captives and other equity-building models.

3️⃣ Build scalable systems that create processes running independently of your daily involvement.

4️⃣ Plan your succession strategy to ensure your business can be sold or transferred.

The time to act is now – not because of external pressure, but because you deserve the wealth you’ve been helping others build. By implementing these strategies, you’re not just securing your family’s future; you’re actively reshaping South Africa’s economic landscape.

💭 What if you saw your clients as long-term assets to nurture, rather than sources of monthly commissions? What’s your first move toward building a business that lasts beyond your working years?

🎙️Ready to learn more about building wealth as a financial advisor? Listen to the full episode of The Cutting Edge Podcast here.